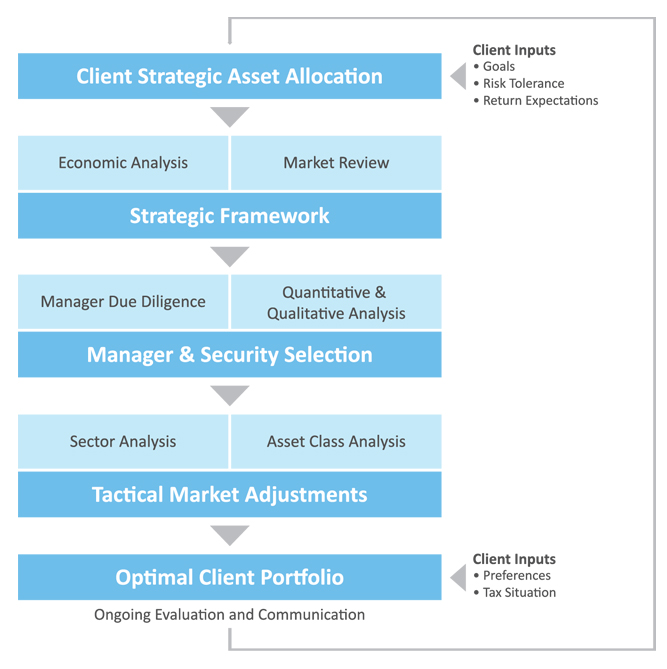

Investment Process

Everything we do begins and ends with you.

We are wealth managers — not merely investment managers. Through our discovery process, we develop a clear, complete and mutual understanding of your goals, hopes and aspirations… and why those are important to you. We use the entire picture that’s been painted to help you make wise decisions that we believe afford you the highest probability of success.

We use your success to measure our own.

Investment Types

Blossom Wealth Management recommends a diverse selection of investment options. In constructing portfolios for our client’s wealth, we like publicly traded securities for a number of reasons, but the liquidity of those investments are something we value greatly. We believe in constructing portfolios in two ways one way is to use stock and bond index funds (typically ETFs) to build out asset allocation strategies to take advantage of their no-load, low turnover, passively constructed, and low expense-ratio characteristics. The second way we construct model portfolios is through owning individual stock positions of roughly 30-40 names with a range of different strategies from growth to income. Finally, we will build customized stock and bond portfolios tailored to specific client needs and interest on request.

Our client investment portfolios may also include a variety of individual short and intermediate term fixed income securities diversified across different issuers and economies. These include CDs, government bonds, corporate bonds, municipal bonds, and inflation protected securities. For clients with larger fixed income portfolios, a combination of bond funds and individual fixed income securities are often recommended. Fixed income investment recommendations are based on portfolio requirements and the reality of market conditions.

Existing client investments are evaluated as part of our planning and portfolio design process, including developing a plan for repositioning assets into a new portfolio. We’ll offer investment advice on any and all investments held by our clients throughout the advisory relationship. Once a portfolio is built (or rebuilt), Blossom Wealth Management monitors holdings and strategic asset allocation on a continuous basis, providing regular reviews for all clients.

When using mutual funds, we particularly like the passively managed index funds offered by Dimensional Fund Advisors (DFA). DFA mutual funds offer broad diversification and are structured for low turnover, reduced trading costs, and reduced capital gains distributions. We also utilize Vanguard Funds, other index funds, and some Exchange Traded Funds (ETFs). Publicly traded Real Estate Investment Trust securities (REITs), gold and commodity mutual funds, or ETFs may be recommended to further diversify asset allocation.

Cash in Investment accounts are typically swept into the bank or money market mutual fund accounts of the institutions where clients hold their assets (Charles Schwab). We work with clients to assess upcoming cash flow needs and create a plan for meeting those requirements.

Download PDF - Forbes Dimensional Article

Contact us for a free, no obligation, 30-minute financial consultation.